The tectonic shifts in global trade policies have transformed Ferrite Magnetic Tile production into a chessboard of strategic positioning. China’s industry leaders are responding not with retreat, but with calculated expansions that turn regional trade pacts into springboards for worldwide influence—a masterclass in converting constraints into competitive edges.

Central to this approach is the nearshoring trifecta. In Nuevo León, Mexico, compact factories equipped with AI-driven sintering furnaces produce Ferrite Magnetic Tiles tailored for Tesla’s next-gen EV motors. By processing Chinese-milled strontium ferrite powders onsite, these facilities fulfill the IRA’s 50% local content rule while maintaining proprietary material formulations. The tiles’ unique chromium-doped coatings—developed to withstand North America’s extreme temperature swings—have become a selling point for Canadian EV startups facing Arctic operational challenges .

Across the Pacific, Vietnam’s rare earth boom catalyzes vertical integration. DingFeng’s collaboration with Da Nang’s metallurgists has birthed a closed-loop system: mining waste from Vietnamese monazite processing is repurposed into neodymium-enhanced ferrite composites. These “green tiles” reduce heavy rare earth consumption by 40%, aligning with EU’s upcoming Critical Raw Materials Act thresholds while serving South Korea’s booming appliance sector .

Back home, the dual inventory ecosystem evolves into predictive guardianship. Machine learning models now forecast six-month geopolitical risks, triggering automated purchases of Australian yttrium reserves or Laotian cobalt stockpiles. During the 2025 Q1 Taiwan Strait tensions, the system preemptively rerouted shipments through China-Europe freight trains, avoiding maritime delays for BMW’s Munich production lines .

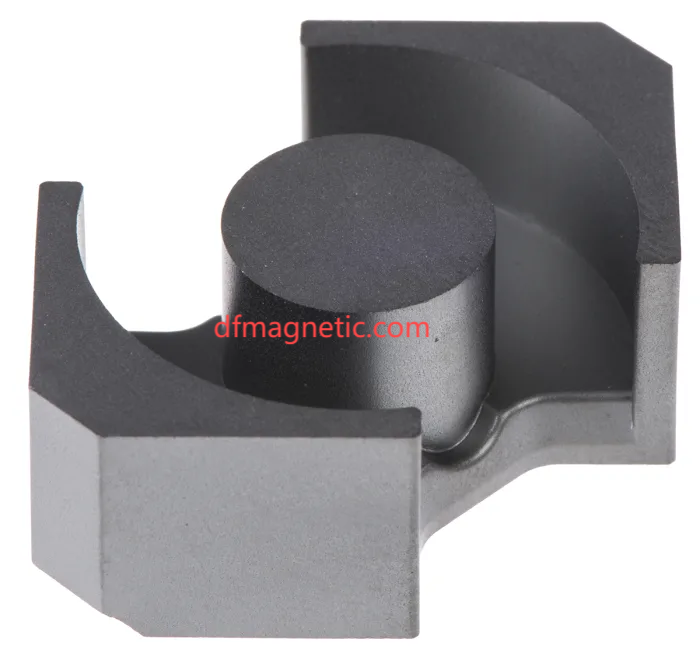

click dfmagnetic.com to reading more information