Overview of GCC P2P Payment Market Size & Future Outlook

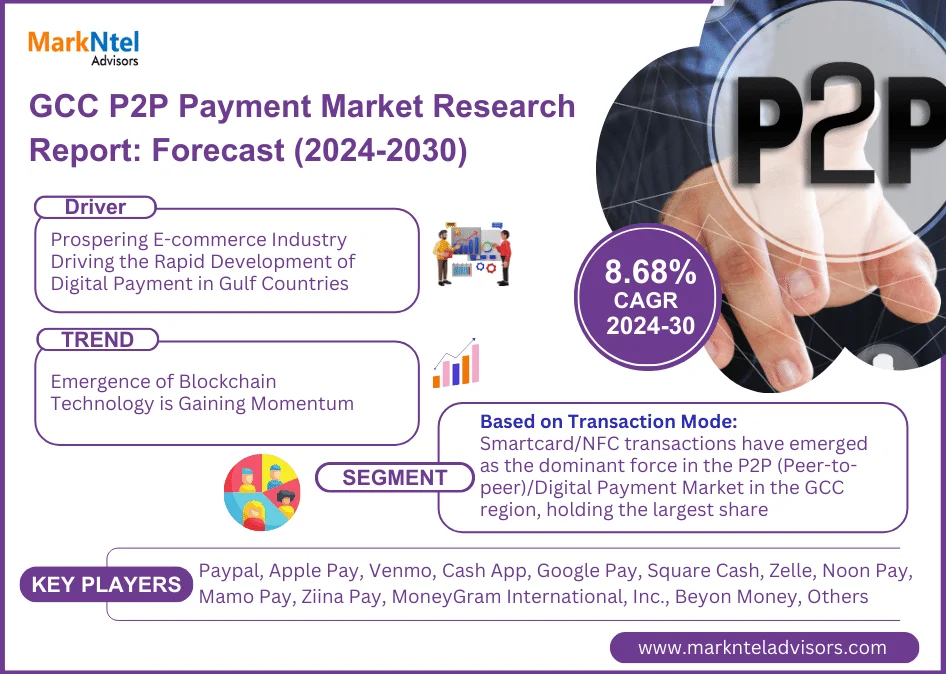

According to the latest report by MarkNtel Advisors, the GCC P2P Payment Market size is estimated to grow at a CAGR of around 8.68% from 2024-2030. This report is designed to enhance user understanding and support informed decision-making by thoroughly analyzing key market shifts, identifying gaps, exploring emerging opportunities, and assessing industry trends and competitive challenges. By combining both qualitative and quantitative data, it offers a comprehensive overview, highlighting growth prospects and providing valuable insights into competitors, helping both established companies and new entrants navigate the current market landscape.

✅In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

If you’re interested in the assumptions considered in this study, you can download the PDF brochure- https://www.marknteladvisors.com/query/request-sample/gcc-p2p-payment-market.html

What are the key drivers influencing the growth of the GCC P2P Payment market?

This section provides a detailed analysis of the market drivers and factors is explored thoroughly below.

Prospering E-commerce Industry Driving the Rapid Development of Digital Payment in Gulf Countries – The surge in the e-commerce industry in GCC countries like the UAE, Saudi Arabia, Kuwait, Bahrain, etc., is fueling a significant transformation of the consumer experience and prompting the rise of digital payments. Several factors have contributed to the buoyant growth of the e-commerce sector in the region. These include the increasing popularity of social commerce & significant investments in infrastructure, such as efficient fulfillment centers, initiatives by the Dubai Free Zones Council, and strategic partnerships, like the collaboration between Noon.com and eBay.

This further underscores effort to capitalize on the expanding market landscape, setting the stage for a promising future for the e-commerce sector in the UAE and the wider GCC region. These factors led to the increasing demand for online shopping, which fueled a surge in the population of online buyers in the GCC, with the number of online shoppers projected to approach 60%. Further, aiding in thriving the Digital Payment Market across the GCC countries.

How is the GCC P2P Payment market segmented and what are the key factors within each segment?

The GCC P2P Payment market has been further segmented into distinct categories. Analyzing growth within these segments allows you to identify niche opportunities, develop targeted strategies, and understand the variations in your core application areas and target markets.

By Transaction Mode

- Short Message Service (SMS)- Market Size & Forecast 2019-2030, (USD Million)

- Mobile Apps- Market Size & Forecast 2019-2030, (USD Million)

- Smartcard/NFC (Near field communication)- Market Size & Forecast 2019-2030, (USD Million)

- Others (Bank Transfers, Digital Wallets, etc.)- Market Size & Forecast 2019-2030, (USD Million)

By Location

- Remote Payment- Market Size & Forecast 2019-2030, (USD Million)

- Proximity Payment- Market Size & Forecast 2019-2030, (USD Million)

By End User

- Retail & E-Commerce- Market Size & Forecast 2019-2030, (USD Million)

- Travel & Hospitality- Market Size & Forecast 2019-2030, (USD Million)

- Transportation & Logistics- Market Size & Forecast 2019-2030, (USD Million)

- BFSI- Market Size & Forecast 2019-2030, (USD Million)

- Healthcare- Market Size & Forecast 2019-2030, (USD Million)

- Others (IT & Telecom, Media & Entertainment, etc.)- Market Size & Forecast 2019-2030, (USD Million)

By Country

- Saudi Arabia

- The UAE

- Qatar

- Kuwait

- Oman

Browse Full Report Along with TOC and Figures - https://www.marknteladvisors.com/research-library/gcc-p2p-payment-market.html

Who are the Key Market Players in the GCC P2P Payment industry?

The competitive landscape of the GCC P2P Payment market provides a detailed look at the key players in the industry. This includes an overview of each company, their financial performance, revenue generation, and market potential. It also covers their investments in R&D, new market initiatives, production facilities, and strengths and weaknesses. Additionally, the analysis looks at recent product launches, approvals, the range of products offered, their dominance in different applications, and the product life cycle. All of this information is specifically focused on how each company is positioning itself within the market.

Several key players are actively operating in the market, including

- Paypal

- Apple Pay

- Venmo

- Cash App

- Google Pay

- Square Cash

- Zelle

- Noon Pay

- Mamo Pay

- Ziina Pay

- MoneyGram International, Inc.

- Beyon Money

Market Advancement by Leading Companies:

- 2024: Google Pay announced a partnership with NPCI Payment International Limited (NPIL), a subsidiary of the National Payment Corporation of India. Through this partnership, Google pay users would be able to make digital payments in GCC countries, including Oman, Qatar, Saudi Arabia, and the UAE.

Note - If there are any particular details you need that are not currently included in the report, we will be happy to provide them as part of our customization services.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address

Other Report:

- The UAE Sunflower Oil Market Size by 2027 at 3.10% CAGR

- The Middle East Vegetable Oil Market Trends and Forecast Report – 2022-2027

- Diabetes Management Software Market Size, Growth, Trend 2030

- Coronary Stents Market Size, Sales Analysis & Opportunity - 2022-2027

Why Choose MarkNtel Advisors:

- Focused Industry Expertise

- Diverse Report Offerings

- Personalized Research Solutions

- Robust Research Methodology

- In-depth Report Coverage

- Tracking Technological Advancements

- Comprehensive Value-Chain Analysis

- Discovering Market Opportunities

- Analyzing Growth Trajectories

- Assured Quality Insights

- Dedicated After-Sales Support

- Trusted by Fortune 500 Companies

About Us –

We are a leading market research company, consulting, & data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, & individuals, among others.

Our specialization in niche industries & emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, & trend analysis, among others, for 15 diverse industrial verticals.

Contact Us –

Call + +1 628 895 8081, +91 120 4278433

Email: [email protected]