The practice is gradually having a growing uptake for halal-certified products around the world, and, therefore, the Halal logistics industry is also transferring. There is an emerging market for consumable products, which are especially in the drink varieties that cater to the increasing Muslim population through technology, legal actions as well as supply chain tricks. Innovations are arising for better integrated halal solutions, product purity, and supply chain techniques by companies. The aim of this article is to reveal some trends defining the current state and development of halal logistics.

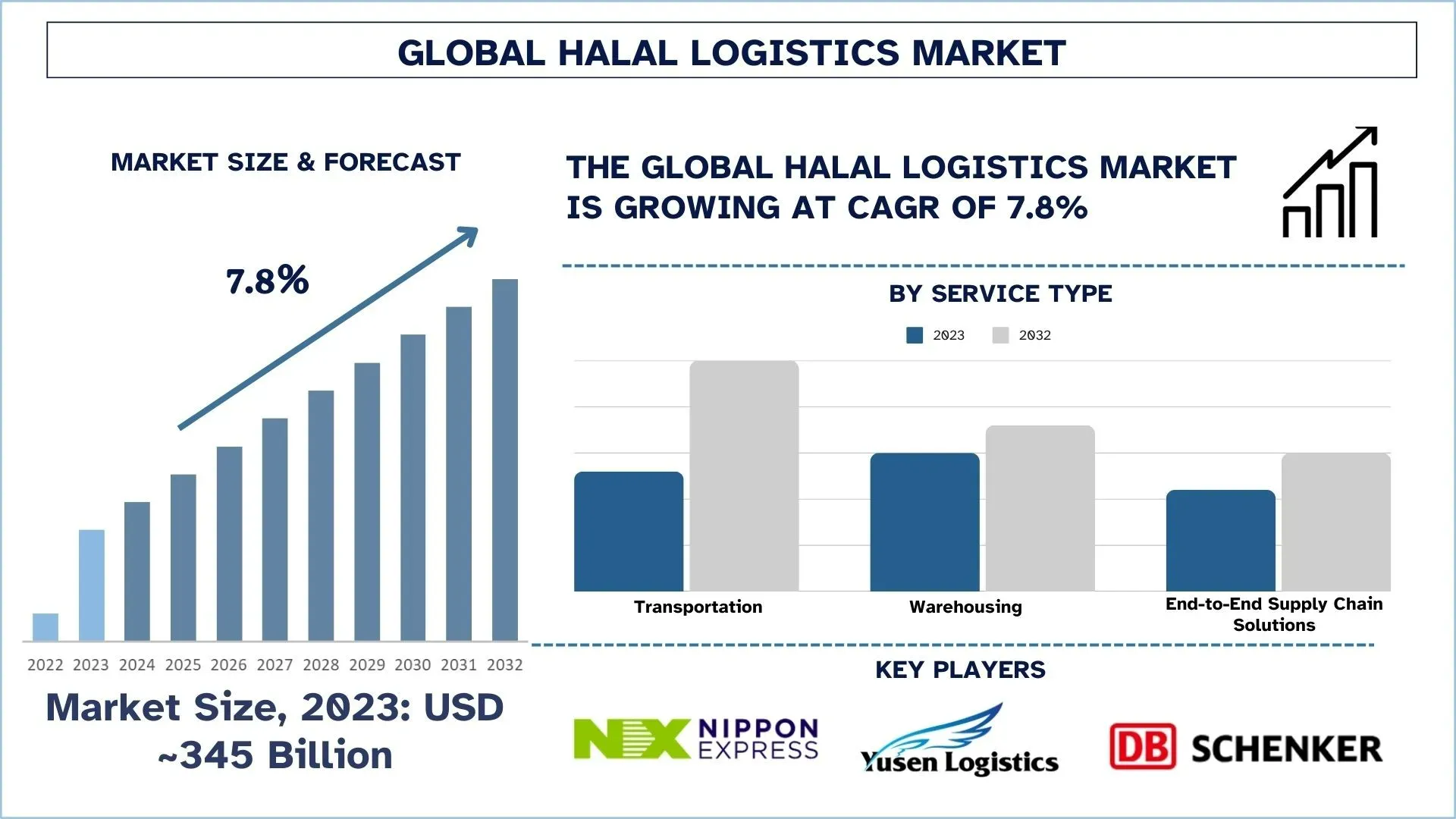

According to the UnivDatos, rising global demand for halal products, stringent regulatory frameworks, growth in the halal food sector, expanding halal pharmaceuticals and cosmetics, rising e-commerce in Muslim-majority markets, and expanding Middle Eastern and Southeast Asian markets drive the Halal Logistics market. As per their “Halal Logistics Market” report, the global market was valued at USD 345 Billion in 2023, growing at a CAGR of about 7.8% during the forecast period from 2024 - 2032 to reach USD Billion by 2032.

For More Detailed Analysis in PDF Format, Visit- https://univdatos.com/reports/halal-logistics-market?popup=report-enquiry

1. Adoption of Blockchain for Halal Compliance

Especially blockchain technology is applied to halal logistics to improve transparency and transparency from supply chain management. Through this, consumers can track the movement of the halal product in real time to confirm that it has complied with all Halal standards. It has a tamper-proof record of product sources, certifications, and transportation history. Malaysia, as well as the UAE, are moving to adopt blockchain in the halal supply chain to reduce fraud and retain consumer confidence.

On May 28, 2024, Marvion Inc., a leading innovator in blockchain technology, announced significant progress in applying our blockchain technology expertise in the development and delivery of blockchain-based Halal projects within the UAE based on our Digital Ownership Token (DOT) technology framework, combining with artificial intelligent modules (AI) to enhance the security framework of the solution. This initiative marks a major milestone in Marvion's commitment to utilizing its proprietary technology to create new intangible assets, beginning with Halal certification.

2. Expansion of Halal Cold Chain Logistics

Due to the increase in consumption of halal food products and other merchandise, such as pharmaceutical products that require cold chain logistics, the topic has emerged as a subject of concern. Businesses are using halal-approved temperature-sensitive flow to avoid mixing between halal and non-halal products. It is most apparent in cold chain logistics since the governments in Southeast Asia and the Middle East, among other regions, are tightening the halal standards for foods and pharmaceuticals to improve their safety.

On 29 October 2021, FGV Holdings Berhad (FGV) introduced cold chain transportation services under its logistics arm, FGV Transport Services Sdn Bhd (FGV Transport) to provide efficient delivery and cold storage solutions for temperature-sensitive products and perishable items.

As of October 2021, FGV has acquired ten 7.5-tonners refrigerated trucks. The Group plans to increase the number to 17 trucks of various sizes and loads by 2023 with an estimated investment of RM4 million,” said Mohd Nazrul, adding that they are also focusing on the halal food production industry which keeps growing year by year.

3. Strengthening of Halal Certification Standards

There is an improvement in certification authorities and the standards set by various governments to govern the logistics business. Some of the countries that have put in place strict compliance rules governing supply chains include Indonesia, Malaysia, and Saudi Arabia; hence, certifying halal logistics is now compulsory among companies supplying goods that are within the halal industry. Thus, the Halal Logistics Standard (MS2400) set by Malaysia is a good reference model that has developed a clear guideline for handling and transporting halal products worldwide.

MS 2400 consists of the following parts, under the general title Halal supply chain. management system:

· Part 1: Transportation - General requirements.

· Part 2: Warehousing - General requirements.

· Part 3: Retailing - General requirements.

4. Halal E-Commerce and Integration of Halal Logistics Industry

Evolutions in logistics are visualized by the increase of values in mobile applications, specifically, halal e-shops being established. Halal-certified products sold on the Internet require special distribution channels to guarantee halal status even during delivery. They are now seeking halal-certified last-mile delivery solutions, separate warehouse space, and continuous tracking and monitoring to enhance the online channel. This trend is more evident in North America as well as Europe since the halal e-commerce segment is experiencing tremendous growth.

5. Development of Dedicated Halal Logistics Hubs

To improve the conditions of serving the halal flow supply chain, some countries have begun to establish halal logistics parks. Malaysia, for instance, has recently established the Halal Logistics Hub through which all Halal products are stored and distributed. The two countries are also developing halal-compliant warehouse facilities for facilitating an efficient international halal trade supply chain system.

6. Increased Investment in Smart Halal Warehousing

Automated warehouses that integrate information technologies, including IoT and AI tracking systems for improved logistics, are another idea being practiced in halal logistics. Such features assist businesses in the onset of halal requirements in terms of controlling the conditions that products are exposed to during handling and storage in processes as they happen. This way, the use of RFID and AI-based monitoring systems includes recognizing probable contamination threats and improving supply chain issues.

7. Global Collaborations for Halal Supply Chain Standardization

Bilateral cooperation initiatives are on the rise due to the processes of setting up comparable international halal logistics systems. Such international bodies as the Organisation of Islamic Cooperation (OIC) and the International Halal Accreditation Forum (IHAF) are also working towards creating uniform standards across the respective regions. This is relevant to all those companies that implement and experience halal logistics to cover all aspects of the business, particularly international.

Explore the Comprehensive Research Overview - https://univdatos.com/reports/halal-logistics-market

Related Reports:

Halal Tourism Market: Current Analysis and Forecast (2024-2032)

Halal Ingredients Market: Current Analysis and Forecast (2022-2028)

Reverse Logistics Market: Current Analysis and Forecast (2022-2028)

Hazardous Goods Logistics Market: Current Analysis and Forecast (2022-2028)

Conclusion

As for the faith-based industry, the halal logistics sector is proving to experience a remarkable transformation due to information technology, better regulations, and customer requirements. The drivers for change are blockchain adoption, halal-certified cold chain logistics, the enhanced certification of the halal industry, and e-commerce. The various factors, including the setting up of halal logistics centers, smart warehouses, sustainability factors, and international linkages, also boost the sector. With the increasing focus and growth of the markets, the businesses must change with the current trends to ensure that all products embedded with ‘halal’ trademarks comply with the increasing demand in global markets.

Contact Us:

UnivDatos

Contact Number - +19787330253

Email - [email protected]

Website - www.univdatos.com