Market Overview:

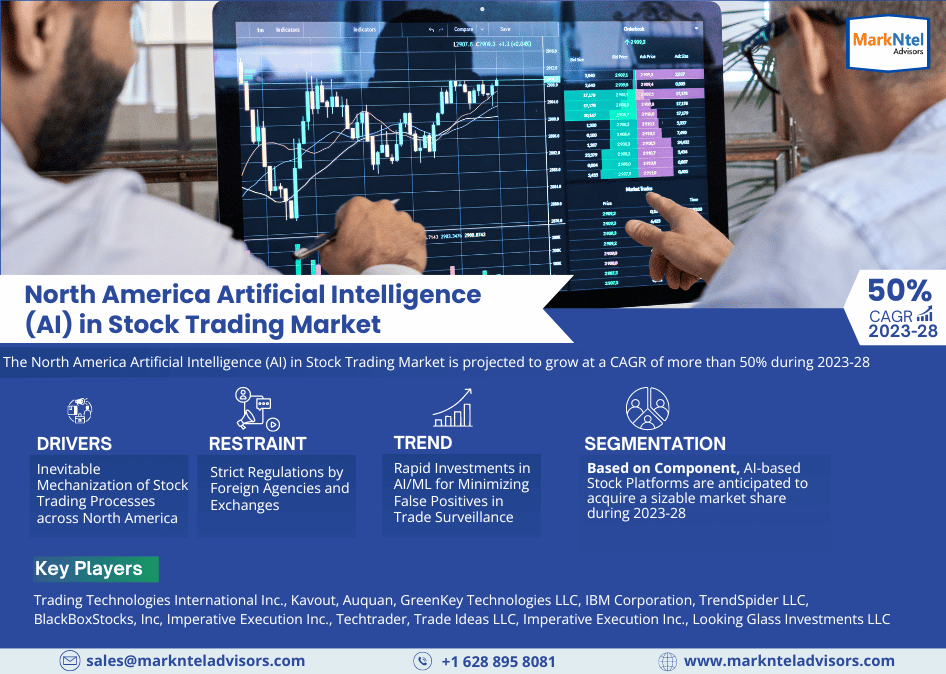

MarkNtel Advisors has released a new report that highlights the strong growth trajectory of the North America Artificial Intelligence (AI) in Stock Trading Market, The North America Artificial Intelligence (AI) in Stock Trading Market size is estimated to grow at a CAGR of around 50% during the forecast period, i.e., 2023-28. Various factors are attributed to the growth of the market like growth in automobile production, growing focus on lightweight & sustainable materials, rising demand for luxury & customized interiors, increasing focus on safety standards, and the adoption of Advanced Driver Assistance Systems (ADAS). The report provides valuable insights into the drivers, trends, and challenges shaping the future of the North America Artificial Intelligence (AI) in Stock Trading Market. It offers an in-depth look at the key players, geographical performance, and the segments leading the charge in market share.

Industry Outlook & Forecasts:

- Forecast Period: 2023-2028

- CAGR (2023-2028): 50%

Key Perks: “In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecasts for the years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.”

Request for a Free PDF Sample of the Report – https://www.marknteladvisors.com/query/request-sample/north-america-ai-in-stock-trading-market.html

North America Artificial Intelligence (AI) in Stock Trading Market Segmentation Breakdown:

The North America Artificial Intelligence (AI) in Stock Trading Market explores the industry by emphasizing the growth parameters and categorizes including geographical segmentation, to offer a comprehensive understanding of the market dynamic. The further bifurcations are as follows:

By Purpose

- Data Processing & Trading Pattern

- Speed Trading

- Regulation & Compliances

- Risk Assessment

- Market Insights & Forecasts

- Trade Recommendations

- Semantic Intelligence

- Others

By Enterprise Structure

- Small & Medium Enterprise

- Large Enterprise

- Others

By End-User

- Banks & Financial Institutions

- Trade House & Brokerages

- Fintech

- Individuals

Among all, Banks & Financial Institutions are anticipated to dominate the market with the largest share in the coming years.

By Trade Channel

- Equity

- Commodity

Geographical Growth Insights:

By Country

- The US

- Canada

- Mexico

Of them all, the US is expected to maintain its dominance in the market during the forecast period. It owes prominently to rapid technological advancements and increasing applications of AI-based trading across the country's banks & financial institutions.

MarkNtel Advisors Highlights Key Market Drivers for North America Artificial Intelligence (AI) in Stock Trading Market:

Inevitable Mechanization of Stock Trading Processes across North America

In recent years, financial investors have begun automating their stock trading activities by employing computer systems. Thus, the incorporation of AI has gained momentum owing to its ability to identify complex stock trading patterns across the market in real time. In addition, the integration of AI in stock trading through machine learning enables high speed & extensive processing power for risk assessment. This shall increase the participation of companies in the forecast period, subsequently stimulating Artificial Intelligence (AI) in the Stock Trading industry in North America.

A Comprehensive Analysis of Leading Companies in North America Artificial Intelligence (AI) in Stock Trading Market

- Trading Technologies International Inc.

- Kavout

- Auquan

- GreenKey Technologies LLC

- IBM Corporation

- TrendSpider LLC

- BlackBoxStocks, Inc

- Imperative Execution Inc.

- Techtrader

- Trade Ideas LLC

- Imperative Execution Inc.

- Looking Glass Investments LLC

Explore More About This Research Report @ https://www.marknteladvisors.com/research-library/north-america-ai-in-stock-trading-market.html

North America Artificial Intelligence (AI) in Stock Trading Market Growth Opportunity:

The Advent of AI-Powered ETFs and AI Stock Pickers

The world of portfolio investment has changed dramatically with the arrival of AI-managed portfolios like exchange-traded funds (ETFs). Since most ETFs are index funds and are not actively managed, they have low expense ratios. With minimal human interference and insignificant security selection need, demonstrated by INDEX funds, integration of AI may make their running substantially easier.

The AI-driven equities exchange-traded fund AIEQ is an illustration of an ETF powered by AI. This actively managed portfolio is the first of its type, which runs the fund and is driven by IBM's Watson artificial intelligence. The S&P 500 consistently outperforms the AI-powered equity ETF or AIEQ.

The adoption of AI Advisers as stock pickers to replace human advisors in actively managed equities funds is another way AI is used to manage portfolios. For instance, BlackRock, the largest American investment management company, has begun to replace human stock pickers with a fully automated investment program built on artificial intelligence algorithms capable of self-learning. Thus, these aspects are likely to present lucrative prospects for the market players.

“Report Delivery Format: Market research reports from MarkNtel Advisors are available in PDF, Excel, and PowerPoint formats. Once payment is successfully processed, the report will be delivered to your email address within 24 hours”

Note: If you need additional information not included in the report, we can customize it to suit your requirements.

Contact Our Analysts for Brochure Requests, Customization, or Any Pre-Purchase Inquiries: https://www.marknteladvisors.com/query/request-customization/north-america-ai-in-stock-trading-market.html

About Us –

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

More Research Studies:

- Global Drip Irrigation Market size was valued at around USD1Billion in 2023 and is projected to grow at a CAGR of around 11.36% during the forecast period 2024-30.

- Discover the booming Global Sustainable Aviation Fuel Market, valued at USD 610Billion in 2022, set to soar at a remarkable CAGR of 56.32% till 2028. Embrace eco-friendly solutions amid rising carbon emissions worldwide

- Explore the Global Automotive Hypervisor Market, valued at USD 213Billion in 2023, with a projected CAGR of 23.2% from 2024 to 2030. Learn about key trends like ADAS demand and AI integration.

Media Contact:

Company Name: MarkNtel Advisors

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Email: [email protected]

Phone: +1 628 895 8081, +91 120 4278433

Website: www.marknteladvisors.com/