Markntel Advisors’ report, UAE Cyber Insurance Research Report: Trend, Business Growth, Size, Future Scope, Segmentation, Dynamics, and Forecast to 2028, offers a comprehensive guide for the growing industry. The expert team of analysts dedicated significant effort to gathering and evaluating the latest market data, resulting in a detailed and up-to-date report that offers valuable insights for individuals who rely on data-driven decisions, including business owners and analysts. The research report on the UAE Cyber Insurance presents well-researched facts and figures pertinent to the industry, whether the goal is to explore new markets, launch a new product, or maintain a competitive advantage.

UAE Cyber Insurance Market Research Report & Market Summary:

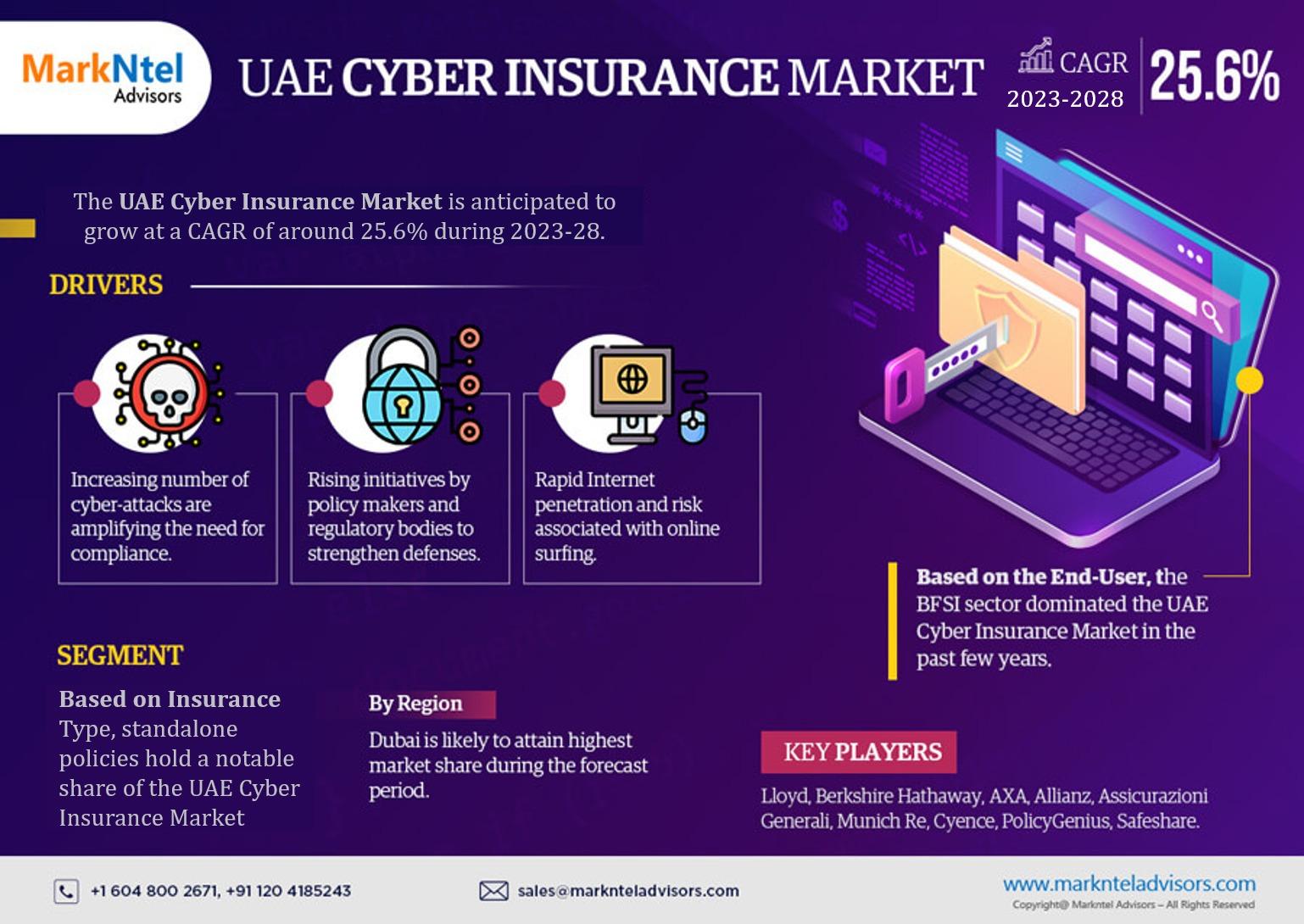

The UAE Cyber Insurance Market is anticipated to grow at a CAGR of around 25.6% during the forecast period, i.e., 2023-28. Most of the market expansion would be propelled by the increasing incidence of cyberattacks among organizations, resulting in massive financial losses, coupled with ever-increasing requirements of enterprises to protect sensitive data from ransomware & malware. Besides, the increasing adoption of advanced technologies like the IoT, AI, etc., coupled with technological advancements like next-generation as well as integrated security solutions and the rapid transition of businesses to cloud-based models, are other prominent aspects projected to stimulate the market expansion through 2028.

✅In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

If you’re interested in the assumptions considered in this study, you can download the PDF brochure- https://www.marknteladvisors.com/query/request-sample/uae-cyber-insurance-market.html

UAE Cyber Insurance Market Dynamics:

Key Driver-

Increasing Instances of Cyberattacks & Data Breaches in the UAE - The rapid digitalization in businesses across the UAE has resulted in an astronomical surge in the incidences of data breaches & cybercrimes. Many sectors like BFSI, retail, and healthcare are becoming the most attractive target for attackers due to the large volume of sensitive customer data within these sectors. Additionally, the increasing adoption of online shopping, mobile banking, Electronic Medical Records (EMRs) is another crucial aspect that proliferates the risk of data breaches in these industries. Hence, the increasing number of cybercrimes is likely to propel the demand for cyber insurance in the year to come.

UAE Cyber Insurance Market Segmentation Analysis:

According to MarkNtel study the market is segmented into the following categories:

By Component

- Solution

- Cyber Insurance Analytics Platform

- Disaster Recovery and Business Continuity

- Cybersecurity Solutions

- Service

- Consulting/Advisory

- Security Awareness Training

- Other Services

By Coverage

- First Party

- Theft and Fraud

- Computer Program and Electronic Restoration

- Extortion

- Forensic Investigation

- Business Interruption

- Third Party

- Crisis Management

- Credit Monitoring

- Regulatory Response

- Privacy and Security Liability

- Network Security Liability

- Media and Communication Liability

By Insurance Type

- Packed

- Standalone

Of both, standalone policies hold a notable share of the UAE Cyber Insurance Market. It owes to their mounting adoption by SMEs that face an ever-increasing risk of cyberattacks, and unlike large enterprises that have dedicated security teams & massive IT budgets, SMEs have low budgets and are often not fully prepared to withstand a cyber-assault.

By Organization Size

- Large Enterprises

- Small & Medium Sized Enterprise

Here, large enterprises account for the largest share in the UAE Cyber Insurance Market since they have a large volume of critical data stored in clouds & other storage areas.

By End-User

- BFSI

- IT & Telecom

- Defence

- Energy & Power

- Retail

- Healthcare

- Others

Of all end-users, the BFSI sector holds the largest share of the UAE Cyber Insurance Market. It owes to the increasing monetary operations in banks & other financial institutions.

By Country

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE.

Of all regions in the UAE, Dubai dominates the Cyber Insurance Market, mainly due to the increasing establishment of businesses within the region. Besides, economic growth across Dubai is encouraging substantial investments in the Research & Development (R&D) activities and mounting focus on developing modern technologies.

As indicated in the latest market research report published by Markntel Advisors, “UAE Cyber Insurance Research Report: Forecast (2023-2028)”, this report offers a detailed analysis of the industry, featuring insights into the UAE Cyber Insurance industry. It encompasses competitor and geographical analyses, as well as recent advancements in the market.

Browse Full Report Along with TOC and Figures - https://www.marknteladvisors.com/research-library/uae-cyber-insurance-market.html

Top Companies Operating in the UAE Cyber Insurance Market:

- Lloyd

- Berkshire Hathaway

- AXA

- Allianz

- Assicurazioni Generali

- Munich Re

- Cyence

- PolicyGenius

- Safeshare.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel, and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address*

Other Report:

- The Latin America Heating Ventilation Air Conditioning & Refrigeration (HAVCR) Market size is valued at around USD4Billion in 2023 and is estimated to grow at a CAGR of about 2.4% during the forecast period, i.e., 2024-29.

- Saudi Arabia Facility Management Market valued at USD29Billion in 2025, is projected to reach USD 33.38 Billion by 2030 with a CAGR of 4.11%.

Key Report Highlights:

- Market Dimensions & Projections

- Pricing Evaluation,

- Recent Strategic Moves by Companies,

- Primary Stakeholders,

- Analysis of Import and Export Trends,

- Competitive Landscape Assessment,

- Emerging Opportunities,

- Market Trends and Indicators

Note - If there are any particular details you need that are not currently included in the report, we will be happy to provide them as part of our customization services.

Frequently Asked Questions (FAQs)-

- What are the industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the market?

- What leading factors would propel and impede the industry across the geography?

- How has the industry been evolving in terms of geography & UAE Cyber Insurance Market adoption?

- How has the competition been shaping up across the geography?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

About Us –

We are a leading market research company, consulting, & data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, & individuals, among others.

Our specialization in niche industries & emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, & trend analysis, among others, for 15 diverse industrial verticals.

Contact Us –

Call + +1 628 895 8081, +91 120 4278433

Email: [email protected]

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Address Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India