Comprehensive Analysis Highlights Market Definition, Growth Drivers, Segmentation, Country-Level Insights, Competitive Landscape, and Future Outlook

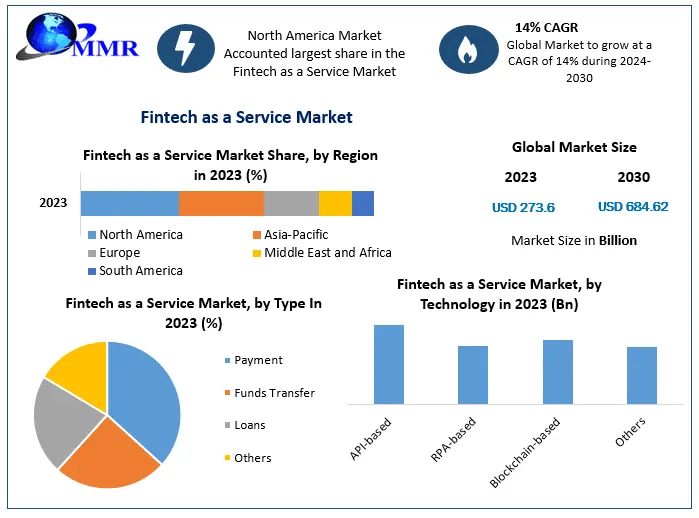

The global Fintech as a Service (FaaS) Market Size is experiencing significant growth, with projections indicating an increase from USD 273.6 billion in 2023 to approximately USD 684.62 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 14% during the forecast period. This expansion is driven by the increasing demand for innovative financial solutions, digital transformation, and evolving regulatory requirements.

Market Definition and Scope

Fintech as a Service (FaaS) refers to the provision of financial services through digital platforms, enabling businesses to offer payment processing, lending platforms, compliance solutions, and data analytics without the need to develop these capabilities in-house. FaaS providers offer agility, flexibility, and seamless system integration, allowing businesses to enhance their financial service offerings and improve customer experiences.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/208737/

Growth Drivers and Opportunities

Several factors contribute to the robust growth of the FaaS market:

-

Digital Transformation: The shift towards digital channels has increased the demand for innovative financial services, prompting businesses to adopt FaaS solutions to stay competitive.

-

Regulatory Compliance: Stricter financial regulations have heightened the need for comprehensive compliance solutions, a niche effectively addressed by FaaS providers.

-

Cost Efficiency: FaaS offers cost-effective and time-efficient financial solutions, reducing the need for businesses to invest heavily in developing proprietary financial systems.

-

Data Analytics: The growing importance of data analytics in the financial sector fuels the demand for FaaS solutions that encompass comprehensive data analytics capabilities.

-

Open Banking: The rise of open banking presents opportunities for Fintech companies to introduce innovative and transformative financial solutions, further driving the FaaS market.

Excited to dive in? Request your sample copy of the report to uncover its contents: https://www.maximizemarketresearch.com/request-sample/208737/

Segmentation Analysis

The FaaS market is segmented based on components, applications, and end-user industries:

-

By Component:

- Payment Processing: Solutions that facilitate electronic transactions, including credit card processing and mobile payments.

- Lending Platforms: Platforms that enable businesses to offer loans and credit services to consumers and other businesses.

- Compliance Solutions: Tools that assist businesses in adhering to financial regulations and standards.

- Data Analytics: Services that provide insights into financial data, aiding in decision-making and strategy development.

-

By Application:

- Banking: Traditional and digital banks leveraging FaaS for various financial services.

- Insurance: Insurance companies utilizing FaaS for policy management, claims processing, and customer engagement.

- Investment: Investment firms employing FaaS for portfolio management, trading, and client reporting.

- Payments: Businesses focusing on payment solutions, including remittances, cross-border payments, and mobile wallets.

-

By End-User Industry:

- Retail: Retailers adopting FaaS for point-of-sale systems, customer loyalty programs, and e-commerce transactions.

- Healthcare: Healthcare providers using FaaS for billing, insurance claims, and patient financial management.

- Education: Educational institutions implementing FaaS for tuition payments, financial aid processing, and alumni donations.

- Government: Government agencies utilizing FaaS for tax collection, social welfare disbursements, and public sector payments.

Country-Level Analysis

-

United States: As a technological leader, the U.S. has a substantial share in the FaaS market. The country's focus on digital transformation and regulatory compliance across industries, coupled with significant investments in Fintech innovation, propels market growth.

-

Germany: Renowned for its advanced financial sector, Germany adopts FaaS solutions to enhance operational efficiency and maintain high-quality standards. The country's emphasis on regulatory compliance and data security further accelerates the adoption of FaaS offerings.

Dive Deeper into the Data! Explore the Full Study on Our Webpage Now: https://www.maximizemarketresearch.com/market-report/fintech-as-a-service-market/208737/

Competitive Landscape

The FaaS market is characterized by the presence of key players driving innovation and competition:

-

Stripe: A leading provider of payment processing solutions, offering a comprehensive suite of APIs for online and mobile payments.

-

Square: Specializes in point-of-sale systems and financial services, enabling businesses to accept payments and manage financial operations seamlessly.

-

Adyen: Offers a global payment platform that integrates various payment methods, providing businesses with a unified solution for payment processing.

-

Plaid: Provides data analytics and connectivity solutions, enabling businesses to access and utilize financial data for various applications.

-

Marqeta: Focuses on card issuing and payment processing, offering customizable solutions for businesses to manage payment operations effectively.

Conclusion

The global Fintech as a Service market is on a trajectory of substantial growth, driven by technological advancements and the increasing need for digital transformation and regulatory compliance across industries. As businesses continue to embrace digital financial services, FaaS stands at the forefront of transforming how financial solutions are delivered, promising enhanced efficiency, security, and customer experiences in the years to come.

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Get in Touch with Maximize Market Research:

For more information on the Fintech as a Service Market and to access the full report, please contact us:

Maximize Market Research

3rd Floor, Navale IT Park, Phase 2

Pune-Bangalore Highway, Narhe, Pune, Maharashtra 411041, India

Email: [email protected]

Phone: +91 9607365656