Decentralized Finance Market Poised for Explosive Growth, Projected to Reach USD 332 Billion by 2030

Market Estimation & Definition

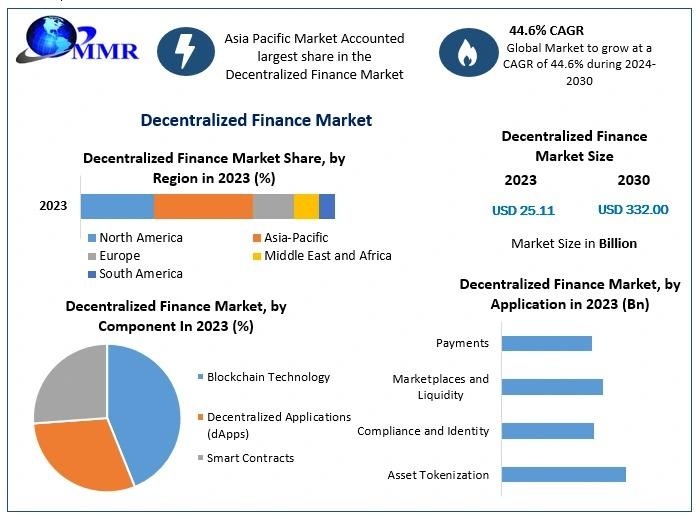

The global Decentralized Finance (DeFi) Market Size was valued at USD 25.11 billion in 2023 and is anticipated to grow at an exceptional CAGR of 44.6%, reaching nearly USD 332 billion by 2030. Decentralized Finance aims to democratize the financial ecosystem by utilizing blockchain technology to eliminate intermediaries, thereby promoting peer-to-peer interactions. This revolutionary approach provides a spectrum of financial services, including banking, loans, mortgages, and asset trading. DeFi platforms rely on smart contracts, enhancing transparency, security, and accessibility, making them a preferred choice over traditional financial institutions.

To learn more, simply click on the link below:https://www.maximizemarketresearch.com/request-sample/203718/

Market Growth Drivers & Opportunity

The explosive growth of the DeFi market can be attributed to several key factors:

- Financial Inclusivity and Accessibility: DeFi platforms provide financial services to unbanked and underbanked populations, enabling anyone with internet access to engage in financial transactions without traditional banking systems.

- Decentralization and Financial Sovereignty: Operating on permissionless blockchain networks, DeFi platforms empower users with complete control over their financial assets, promoting financial sovereignty.

- Rapid Innovation and Ecosystem Growth: Constant innovation by developers and entrepreneurs is expanding the DeFi ecosystem, attracting institutional investors and technologists interested in decentralized solutions.

- Institutional Adoption: Institutional players, including asset managers and investment funds, are increasingly embracing DeFi for its decentralized risk management tools and compliance solutions.

- Opportunities in User Education and Experience: With DeFi being relatively new and complex, opportunities exist for enhanced user interfaces, educational resources, and improved user experiences to facilitate mainstream adoption.

Despite its immense growth potential, the DeFi market faces challenges, including regulatory uncertainties, security risks, and price volatility. Addressing these concerns through scalable blockchain networks and regulatory frameworks will be crucial for sustained growth.

Segmentation Analysis

According to the report, the DeFi market is segmented based on Component and Application:

-

By Component:

- Blockchain Technology: The dominant segment, holding the largest market share in 2023. Blockchain's secure and transparent infrastructure drives DeFi's core functionalities.

- Decentralized Applications (dApps): Expected to grow at a high CAGR due to their role in providing user-facing financial services, including lending platforms, decentralized exchanges (DEXs), and asset management tools.

- Smart Contracts: Essential for automating transactions within the DeFi ecosystem, this segment is poised for significant growth.

-

By Application:

- Decentralized Exchanges (DEXs): Witnessing substantial adoption, with platforms like Uniswap, SushiSwap, and PancakeSwap leading the market.

- Stablecoins: Expected to grow rapidly due to their role in maintaining stability within the DeFi ecosystem.

- Other Applications: Include Asset Tokenization, Compliance and Identity, Marketplaces and Liquidity, Payments, Data and Analytics, and Prediction Industry.

Explore additional details by clicking the link provided:https://www.maximizemarketresearch.com/request-sample/203718/

Country-Level Analysis

- United States: North America remains at the forefront of DeFi adoption, driven by the widespread acceptance of cryptocurrencies and blockchain technology. The presence of key market players and innovative DeFi platforms such as Uniswap and Compound further accelerates growth.

- Germany: In Europe, Germany is leading the DeFi revolution, leveraging its robust financial ecosystem and progressive regulatory landscape. The country's interest in blockchain technology and cryptocurrencies positions it as a major player in the European DeFi market.

Competitive Analysis

The DeFi market is highly competitive, with several key players driving innovation. Major competitors include:

- Uniswap and SushiSwap: Dominant in the decentralized exchange segment, offering seamless token swaps and liquidity pools.

- Aave and Compound: Leaders in the lending and borrowing space, providing decentralized financial products with high yields and flexible terms.

- MakerDAO and Yearn Finance: Renowned for their stablecoin solutions and yield farming protocols, respectively, contributing to market stability and growth.

The competitive landscape is characterized by rapid innovation, strategic partnerships, and acquisitions, as companies strive to expand their market presence. Continuous development in security features, user experience, and regulatory compliance is pivotal for maintaining a competitive edge.

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Bangalore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 9607195908, +91 9607365656