According to the report by Expert Market Research (EMR), the Europe construction products market attained a value of USD 96.87 billion in 2024. Aided by the region’s strong emphasis on infrastructure development, sustainability, and energy efficiency in buildings, the market is anticipated to grow at a CAGR of 2.30% during the forecast period of 2025-2034, reaching a value of USD 121.60 billion by 2034.

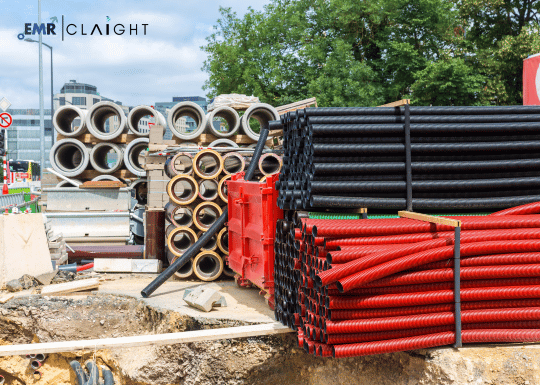

Construction products, which include materials such as cement, concrete, bricks, glass, insulation, roofing, and flooring, are integral to the creation, maintenance, and renovation of residential, commercial, and industrial buildings. The European construction industry has shown remarkable resilience, driven by public and private investments, renovation programmes, and regulatory frameworks promoting low-carbon and energy-efficient construction.

The increasing demand for green and sustainable building materials is playing a key role in supporting the Europe construction products market growth. With mounting pressure to reduce environmental impact and adhere to strict EU building codes and standards, there is growing adoption of eco-friendly materials such as recycled aggregates, energy-efficient insulation, and low-emission concrete. As climate goals continue to shape construction practices, the demand for advanced construction products is expected to grow steadily across the region.

Market Size

The construction products market in Europe, valued at USD 96.87 billion in 2024, reflects the substantial scale and importance of the construction sector in the region’s economy. This market encompasses a wide variety of building components used in residential housing, commercial spaces, transportation infrastructure, and industrial facilities. Factors such as urbanisation, demographic shifts, and ongoing efforts to modernise outdated infrastructure are contributing significantly to the expansion of this market.

Government incentives for green renovation and energy efficiency improvements in buildings are further bolstering market growth. Additionally, increased funding from the European Union, particularly through initiatives such as the Green Deal and Recovery and Resilience Facility, is injecting capital into construction and renovation projects, thereby enhancing the demand for modern construction products.

Access Your Free Sample Report

Market Share

The residential construction segment holds a significant share in the Europe construction products market, owing to the strong demand for new housing and renovation of existing structures. Renovation activities dominate in Western Europe, particularly in countries like Germany, France, and the United Kingdom, where upgrading aging housing stock is a major focus. In contrast, Eastern European nations are seeing rapid growth in new construction driven by urban development and economic progress.

In terms of product type, cement and concrete products lead the market due to their foundational use in all types of construction. Insulation materials are also gaining prominence, supported by stringent regulations on building thermal performance and energy efficiency.

From a regional standpoint, Western Europe commands the largest share of the market, supported by well-developed infrastructure, mature construction industries, and ambitious sustainability targets. Central and Eastern Europe are emerging as high-growth regions, where investments in public infrastructure, transport networks, and residential development are accelerating.

Market Trends

One of the most significant trends influencing the Europe construction products market is the rising focus on sustainable construction. With Europe aiming to become climate-neutral by 2050, there is increasing demand for building materials with lower environmental footprints. This includes the use of low-carbon cement, recycled steel, reclaimed wood, and bio-based insulation materials.

Another important trend is the growing adoption of prefabricated and modular construction techniques. These methods offer cost-efficiency, speed, and reduced on-site waste, making them attractive in urban areas facing space and time constraints. As modular construction gains traction, manufacturers of construction products are innovating to create materials tailored to off-site production.

Digitalisation is also shaping the market. The adoption of Building Information Modeling (BIM), smart construction technologies, and digital supply chain management is improving efficiency and accuracy in material usage, planning, and logistics.

Additionally, demographic and lifestyle changes, such as increased demand for affordable housing and flexible living spaces, are influencing the types and specifications of construction products in demand.

Drivers of Growth

The Europe construction products market is driven by several key factors. Chief among them is the growing demand for infrastructure renovation. A significant portion of the European building stock is decades old, leading to rising investments in retrofitting and upgrading buildings to meet modern safety, energy, and comfort standards.

Sustainability targets and climate commitments are compelling governments and businesses to adopt construction products that support energy efficiency and reduce carbon emissions. Regulatory frameworks such as the Energy Performance of Buildings Directive (EPBD) and national-level building codes are accelerating the uptake of green materials.

Urbanisation and population growth in key European cities are also contributing to construction activities, especially in the residential and commercial sectors. Increasing urban density has triggered demand for innovative, space-saving construction solutions.

Further, strong policy support through financial incentives, tax rebates, and public-private partnerships for green and smart buildings is catalysing the use of advanced construction products across the region.

Technology and Advancement

Technological advancements are playing a pivotal role in transforming the Europe construction products market. Modern manufacturing techniques, such as 3D printing and automation, are enabling the production of custom, high-performance building components at scale. These innovations are helping reduce waste, lower production costs, and ensure consistency in quality.

Smart materials, such as self-healing concrete, thermochromic glass, and phase-change materials, are gradually entering the market, offering enhanced durability, thermal regulation, and energy efficiency. As R&D investments increase, these advanced materials are expected to become more accessible and widely adopted.

The rise of digital tools and platforms, particularly BIM, is facilitating seamless planning and execution in construction projects. By integrating construction product specifications with project blueprints, BIM enhances efficiency and reduces errors during the building process.

Additionally, innovations in logistics and supply chain management, driven by AI and IoT, are improving the availability and delivery of construction products, particularly for large-scale and time-sensitive projects.

Key Players

The Europe construction products market is moderately fragmented, with numerous multinational and regional companies competing based on innovation, product quality, price, and sustainability credentials. Some of the key players operating in the market include:

- Saint-Gobain S.A.

- CRH plc

- Holcim Ltd.

- Ferguson Construction Ltd.

- Sika Group

- Heidelberg Materials

- Tarkett S.A.

- Kingspan Group PLC

- AkzoNobel N.V

- BMI Group

- Others

These companies are focusing on strategic mergers, acquisitions, and collaborations to expand their product offerings and geographic reach. Emphasis is being placed on developing low-carbon and recyclable construction products, with many leading players investing in R&D to address emerging environmental and performance requirements.

Challenges and Opportunities

Despite a positive outlook, the Europe construction products market faces several challenges. Volatility in raw material prices and supply chain disruptions, particularly for products like steel, timber, and cement, can impact production and profitability. Moreover, the high cost of sustainable materials and green technologies may deter adoption among cost-sensitive builders and consumers.

The sector also faces a skilled labor shortage, particularly in regions with high construction activity. This shortage can slow down project timelines and increase construction costs.

However, the market is replete with opportunities. The strong push for green renovation of buildings, especially under the EU’s Renovation Wave initiative, is expected to drive significant demand for insulation, energy-efficient windows, and smart building materials. Expanding urban areas and the growing need for affordable housing present additional opportunities for innovative and cost-effective construction products.

Further, advancements in circular economy practices offer potential for product manufacturers to create value from recycled materials, waste reduction, and closed-loop production systems.

Market Forecast

Looking ahead, the Europe construction products market is set for steady growth over the next decade. With a projected CAGR of 2.30% from 2025 to 2034, the market is expected to rise from its 2024 value of USD 96.87 billion to USD 121.60 billion by 2034.

This growth will be driven by the increasing focus on sustainability, ongoing urban development, supportive regulatory frameworks, and technological innovation in building materials. As stakeholders across the construction value chain align their strategies with climate goals and smart construction practices, the demand for advanced and eco-friendly construction products in Europe is anticipated to grow, reinforcing the sector’s role in shaping a sustainable and resilient built environment.